The myth and the truth about investing in US market

When I discuss investing in the US market with friends, they often share what they believe to be the truth about it. However, these beliefs are frequently incorrect. I share my thoughts below:

Myth 1 about US market: I'm struggling to manage the Malaysian market and still exploring the US market?

The Truth: For the past ten years, investing in US index (ETF SPY) and you could have made 180% profit, compared to KLCI you still losing 11%.

US market has gone in uptrend for the past many decades mainly due to:

i) Inflation:

As inflation rises over time, consumer prices increase accordingly. This typically leads to higher nominal consumer spending, which directly boosts the revenue of U.S. companies.

ii) Wage, Population, and Consumer Growth:

Rising wages, population growth, and increasing consumer demand all contribute to higher spending, similar to the effect of inflation. These factors support long-term revenue and earnings growth for U.S. companies.

iii) Political Stability:

Compared to countries like China or Malaysia, the U.S. offers a relatively stable political environment. This reassures global investors and sustains long-term confidence in the U.S. market.

iv) Index Rebalancing:

Weaker-performing companies within major U.S. indices are periodically replaced by stronger ones. This ongoing rebalancing process contributes to the indices’ long-term upward trend.

v) Global Corporate Leaders:

Many of the world’s leading companies are headquartered in the U.S. By investing in U.S. stocks, investors indirectly become part-owners of these global giants.

vi) Tax Efficiency:

Top U.S. multinational companies often benefit from favorable tax structures, with subsidiaries operating in low or zero-tax jurisdictions. This allows them to retain more profit, which is reflected in their quarterly results.

vii) Employee Incentives:

Most U.S. companies offer shares to their employees, aligning their interests with the company's performance. This motivates staff to focus on driving sales, increasing profits, and supporting consistent annual growth. As a result, the company’s stock price tends to trend higher over time—benefiting both the business and its employees through capital appreciation and ownership value.

Myth 2 about US market: I will got a heart-attack seeing the US stock prices as they move too fast

The Truth:

- For short term trading, suppose we should not see the price movement too often, in order to produce good results. This could be done by using the stop-loss function, together with a comprehensive trading plan.

- For investment, we can invest in top 1% of global companies in US market, so in the long run we will do well if we pick the right ones. This is why I never check my prices for my investment positions, unless a friend brings them up for discussion. Or close your eyes and buy SPY/QQQ/DIA ETF, (representing S&P500, NASDAQ or DJIA index), they are in the uptrend in long run... unless one day China overtakes the US 🤷🏼♂️

- Again If 10 years ago u close your eyes and buy SPY, now you are making 180%. This is the best proof.

Myth 3 about US market: I need to pay more buying a US stock by 4.3x (exchange rate).

The Truth: We can actually buy as low as 1 unit of share in US. If we normally buy RM4300 for a stock in MY market, then just buy 1 share of a USD1000 stock, the value is still the same. If a RM 1 stock (in MY) can move up within a %, US stock have the potential to move up even more because of all the advantages mentioned earlier, especially we can choose the top 1% companies in the world to invest in.

What are you waiting? Jom and open a US account!

To open US account via M+ Global, visit here:

https://joy-of-trade.blogspot.com/2024/06/want-to-open-m-global-myushk-account.html

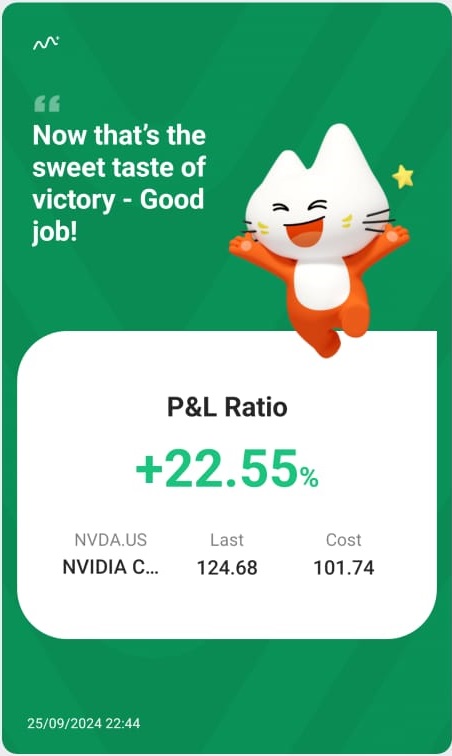

P/S: After opening an account using P3KI invitation code, You will be invited to join my personal group where I share the intrinsic value (IV) of the top companies to my clients, and we only buy when the price is trading below the IV. The below are some of the stocks which benefited us since we holding them since May 2023.

Comments

Post a Comment